The global foreign exchange market, the largest and most liquid financial market in the world, has always experienced cycles of calm and turbulence. What sets 2025 apart is not just the presence of market volatility but its persistence, speed, and complexity. Currency markets are moving faster, reacting more sharply, and remaining unstable for longer periods than traders were accustomed to in the previous decade.

Forex market volatility in 2025 is no longer driven by a single dominant force. Instead, it results from overlapping macroeconomic pressures, central bank policy divergence, persistent inflation dynamics, geopolitical risk, and structural changes in liquidity flows across the global financial system.

For traders, this environment presents both opportunity and risk. Those who understand the underlying drivers of currency market volatility are better positioned to adapt their strategies, manage exposure, and avoid being caught on the wrong side of sharp price movements.

This article explains why forex volatility is rising in 2025, what fundamentally differentiates this cycle from past ones, and how traders can realistically adapt to the new market regime.

Understanding Forex Market Volatility

Forex market volatility refers to the degree and speed at which currency prices fluctuate over a given period. High volatility means larger price movements within shorter timeframes, while low volatility implies more stable and predictable market prices.

Volatility itself is not inherently negative. In fact, volatility creates trading opportunities. Without price movement, there is no profit potential. The challenge arises when volatility becomes erratic, sentiment-driven, or disconnected from traditional technical and fundamental signals.

In 2025, currency market volatility is elevated across both major and emerging market currency pairs. The US dollar, euro, Japanese yen, and British pound have all experienced sharp intraday swings, while emerging market currencies face amplified moves due to capital flow sensitivity and geopolitical exposure.

Central Bank Interest Rates and Policy Divergence

One of the most significant drivers of forex volatility in 2025 is the divergence in central bank interest rate policies implemented by government agencies worldwide.

After years of coordinated monetary easing during global crises, central banks are now operating on different timelines, responding to domestic inflation, growth, and political pressures.

The US Federal Reserve continues to balance inflation control against economic slowdown risks, creating uncertainty around the timing and pace of rate cuts.

The European Central Bank faces uneven growth across the eurozone while managing lingering inflation in services and wages, including labor statistics that influence nominal interest rates decisions.

The Bank of Japan remains an outlier, slowly adjusting its ultra-loose stance, which has led to sharp yen volatility and periodic intervention fears.

This divergence matters because interest rate expectations directly influence currency valuations. When traders anticipate changes in central bank policy, capital flows shift rapidly across borders, amplifying forex volatility.

In 2025, these expectations are constantly repriced. Economic data surprises, political statements, and even subtle changes in central bank language are enough to trigger sharp currency moves.

Inflation Impact on Forex Markets

Inflation remains a central theme in 2025, even as headline numbers have moderated in some regions. The issue is not whether inflation exists, but how sticky it has become and how unevenly it affects different economies.

Inflation impacts forex markets through several channels:

- It influences interest rate decisions

- It affects consumer demand and economic activity

- It changes trade balances and capital flows

Traders closely monitor inflation indicators such as the Consumer Price Index (CPI) and Producer Price Index (PPI), which reflect the percentage change in a market basket of goods and services purchased by urban consumers, because they shape expectations for future monetary policy. In 2025, inflation data has become more market moving than ever.

Small deviations from forecasts can trigger aggressive repricing across currency pairs, especially when markets are already positioned heavily in one direction.

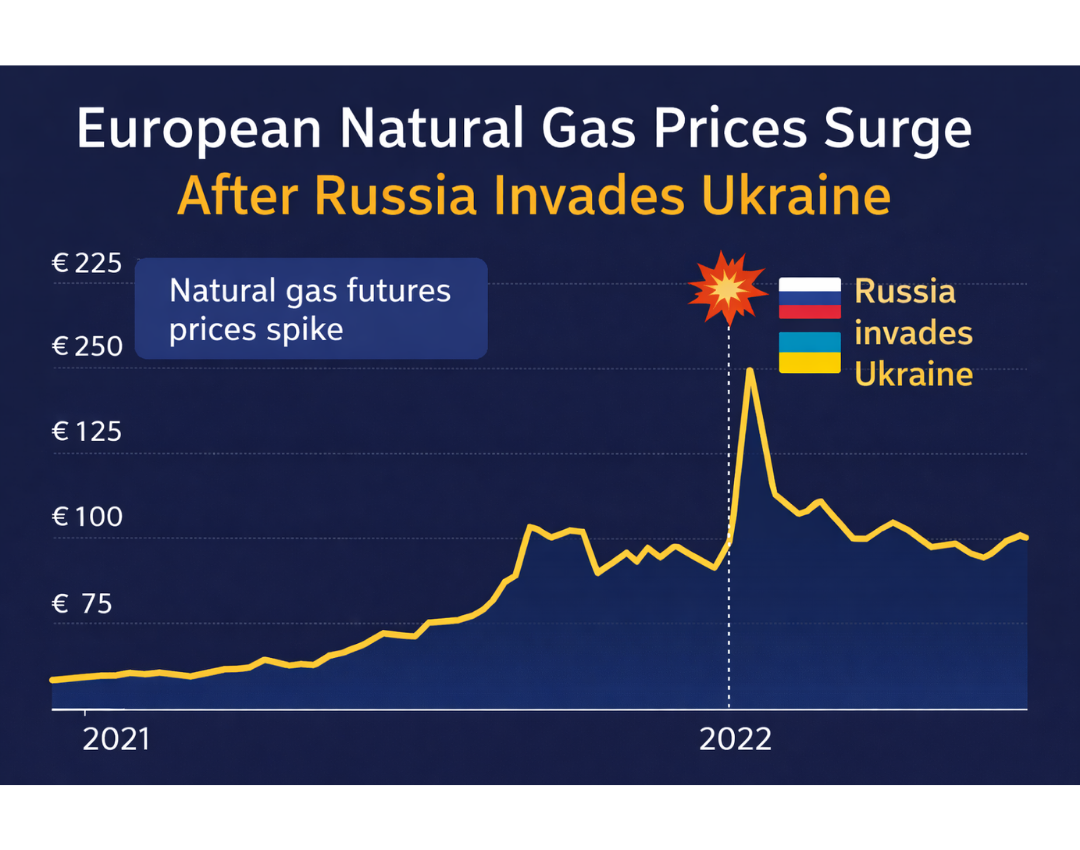

The inflation impact on forex is particularly visible in currencies tied to commodities, energy imports, or emerging markets where fuel inflation directly affects political stability and capital confidence.

CPI and Forex Trading in 2025

Consumer Price Index releases are among the most watched events on the forex calendar. In 2025, CPI and forex trading are more tightly linked due to the narrow margin central banks have to work with.

Markets are no longer reacting simply to whether inflation is rising or falling. They are reacting to the composition of inflation, such as:

- Services versus goods inflation

- Wage growth persistence

- Housing and shelter costs, including less energy services

- Energy and food price volatility

This level of detail has increased short-term volatility around CPI releases, with currencies often experiencing sharp spikes in both directions before establishing a clearer trend.

For traders, CPI days in 2025 require tighter risk controls, wider stops, or reduced position sizes. The assumption that markets will trend smoothly after inflation data is increasingly unreliable.

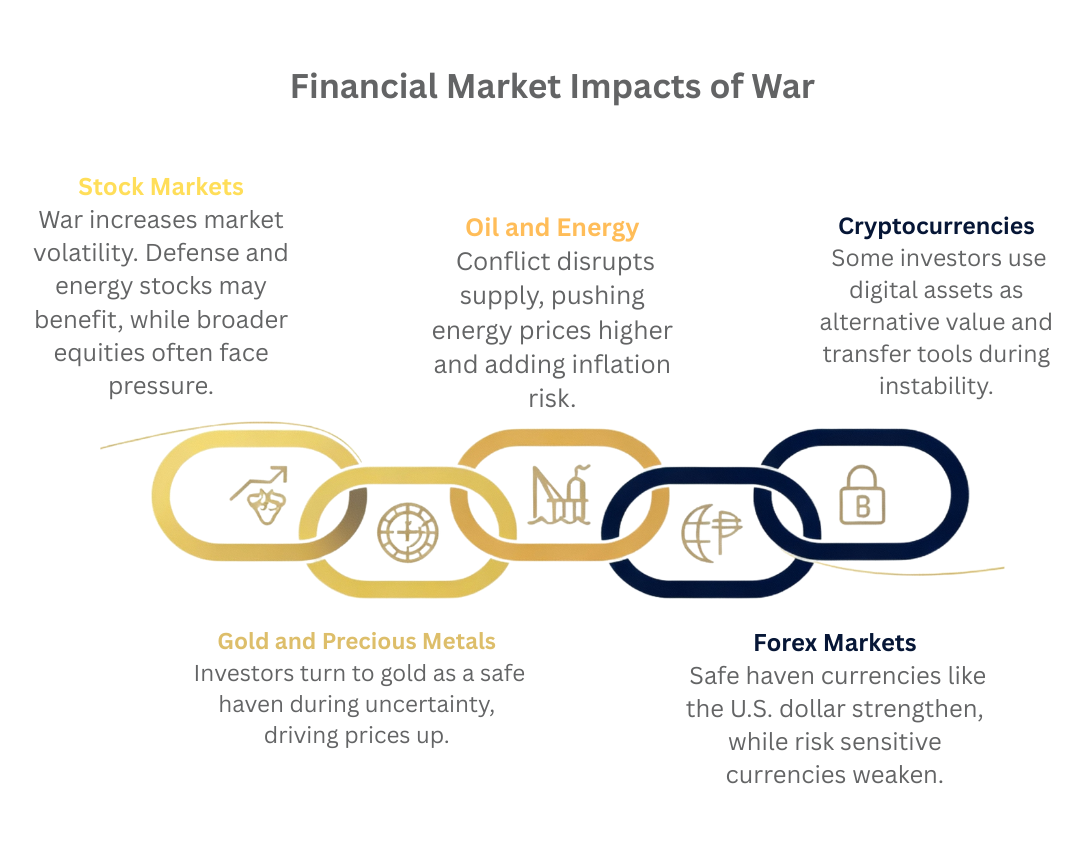

Geopolitical Risk and Currency Market Volatility

Geopolitical risk has always influenced forex markets, but in 2025 it plays a more persistent role rather than causing isolated shocks.

Ongoing conflicts, trade disputes, sanctions, and regional instability continue to affect:

- Energy prices

- Global supply chains

- Safe haven demand

- Emerging market capital flows

Geopolitical risk in forex markets often leads to sudden risk-off behavior, where traders move into perceived safe-haven currencies such as the US dollar or Swiss franc, while higher-risk currencies experience rapid depreciation.

What makes 2025 different is the frequency and overlap of geopolitical events. Markets have less time to stabilize between shocks, which keeps volatility elevated even during periods of low economic news flow.

USD Volatility Forecast and the Role of the Dollar

The US dollar remains the most influential currency in the global financial system, and its behavior in 2025 is a major source of forex market volatility.

USD volatility in 2025 is driven by several factors:

- Shifting expectations around Federal Reserve policy

- Large fiscal deficits and debt sustainability concerns

- Safe haven demand during global uncertainty

- Changes in global trade and reserve diversification

Unlike previous cycles where the dollar followed clearer trends, 2025 has seen frequent reversals. The dollar strengthens on risk aversion but weakens when markets anticipate rate cuts or improved global growth.

This push and pull dynamic has increased volatility across major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, making trend-following strategies more challenging.

Structural Changes in Forex Liquidity

Another often overlooked driver of forex volatility in 2025 is structural change in market liquidity.

The forex market has become more fragmented due to:

- Increased algorithmic and high-frequency trading

- Reduced bank market-making capacity

- Regulatory capital requirements imposed on commercial banks

- Growth of retail trading platforms and speculative trading

During periods of stress or major news releases, liquidity can thin out quickly. When liquidity drops, even moderate order flow can cause exaggerated price moves.

This explains why traders sometimes see sharp spikes or gaps that are not fully justified by fundamentals alone.

What Higher Forex Volatility Means for Traders

Higher volatility does not automatically mean better trading conditions. It changes the nature of risk and reward.

In 2025, traders face:

- Larger intraday price swings

- More frequent stop losses

- Faster sentiment reversals

- Increased emotional pressure

Strategies that worked well in low volatility environments may struggle when markets become choppier and less predictable.

At the same time, higher volatility creates opportunities for traders who adapt correctly. Range expansion, breakout strategies, and short-term tactical trading can benefit from increased movement when risk is managed properly.

How Traders Can Adapt to Forex Volatility in 2025

Adaptation is not about predicting every move. It is about adjusting expectations, risk parameters, and execution.

Key adjustments include:

Risk Management First

Position sizing becomes more important than entry precision. Smaller positions with wider stops often perform better than large positions with tight risk in volatile markets.

Flexible Timeframes

Shorter timeframes may experience excessive noise, while higher timeframes can help filter false signals. Many traders in 2025 are combining intraday execution with higher timeframe bias.

Event Awareness

Economic calendars are no longer optional. Traders must know when CPI, central bank speeches, or geopolitical developments are scheduled and adjust exposure accordingly.

Realistic Expectations

Volatile markets do not move in straight lines. Partial profits, scaling out, and accepting smaller gains can improve consistency.

Long Term Perspective on Forex Volatility

While 2025 feels unusually volatile, it may represent a structural shift rather than a temporary phase. The era of ultra-low rates, abundant liquidity, and predictable policy may be behind us.

Future forex markets are likely to remain sensitive to data, politics, and global risk for longer than many traders expect.

Those who build adaptable systems, respect risk, and understand macro drivers will be better positioned than those relying purely on mechanical or outdated approaches.

Conclusion

Forex market volatility in 2025 is the result of intersecting forces rather than a single catalyst. Central bank interest rate divergence, persistent inflation dynamics, geopolitical risk, and structural liquidity changes have created a more complex and demanding trading environment.

For traders, this environment rewards preparation, discipline, and adaptability. Volatility is not something to fear, but it must be respected.

Understanding why currency markets are moving the way they are is the first step toward trading them effectively in 2025 and beyond.

Additional Insights on Market Volatility and Inflation Dynamics

In addition to the factors discussed, market volatility in 2025 is also influenced by evolving inflation expectations and the money supply. Central banks’ efforts to manage inflation through monetary policy adjustments impact the quantity theory of money the quantity of money circulating in the economy which in turn affects purchasing power and price stability.

Core inflation, which excludes volatile food and energy prices, has become a critical indicator for policymakers and traders alike. Persistent core inflation signals underlying price pressures that may prompt central banks to tighten monetary policy, leading to increased forex market volatility.

Supply shocks, such as natural disasters or disruptions in production costs, continue to create sudden price increases, which ripple through currency markets. Demand shocks, including shifts in aggregate demand due to fiscal stimulus or economic slowdowns, also contribute to the unpredictable nature of price movements.

Retail traders, market makers, and forex brokers are playing an increasingly significant role in forex liquidity and volatility. The rise of electronic trading platforms and the accessibility of currency trading have expanded participation, sometimes amplifying short-term price swings.

Understanding these complex interactions between annual inflation rate trends, monetary policy, and market participant behavior is essential for navigating the heightened market volatility observed in 2025.